The Regulated Way to go On-chain

Go to Platform

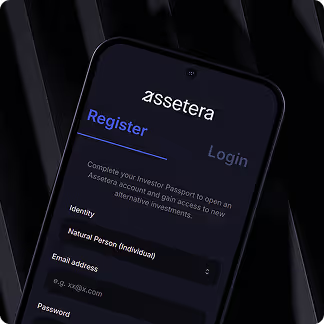

Register on our EU-regulated platform for tokenized real-world assets.

Go to Platform

Go to Platform

Register on our EU-regulated platform for tokenized real-world assets.

Go to Platform

Live Operating platform for:

Regulatory notifications across the EU and EEA, including: Norway, Liechtenstein, Iceland.

Media, insights, and product updates.

Our partners and advisors span across capital markets, financial regulation, and blockchain technology, and the network is growing fast.

Fintech entrepreneur with 20 years of executive experience at leading institutions including GE Capital, Western Union Bank, Raiffeisen Bank International, and Fidor Bank. He also worked in venture capital and private equity before founding Assetera.

Technology and finance professional with over 20 years of experience across capital markets, blockchain, and fintech. Former executive at the London Stock Exchange Group, where he led digital asset initiatives, before joining Assetera as CTO & CPO.

Finance and capital markets expert with over 15 years of experience in investment banking, structured finance, and digital assets. Previously held senior roles at Deutsche Bank and Börse Stuttgart before joining Assetera.